Unlocking Stability and Yield: Insights from Sharad Vohra, Astra Asset Management

A Guide to EUR Investment Grade (IG) CLOs in Diversified Portfolios

By Sharad Vohra, Astra Asset Management

EUR Collateralized Loan Obligations (CLOs) have emerged as a resilient asset class since their inception. In this article Sharad Vohra at Astra Asset Management Ltd delves into the historical performance, enhanced structural features, and comparative advantages of EUR IG CLOs, advocating for their essential role in providing diversification to a fixed-income portfolio.

EUR CLOs were born as an asset class in the year 2000; total issuance that year was EUR 2.4 billion and reached an all-time peak of EUR 42.6 billion in 2007, just before the great financial crisis (“GFC”) of 20081. Post GFC the new issue EUR CLO market started back in earnest in 2013 in its current form (also known as 2.0 CLOs or Post-Crisis CLOs) and has since seen very healthy issuance every year. The underlying assets in a EUR CLO are primarily senior-secured corporate loans that have a first lien on assets of the underlying obligor. CLOs provide exposure to diversified portfolios of loans which are managed by professional CLO managers.

As an asset class, EUR CLOs in general and the investment grade tranches in particular have provided investors with higher yields relative to identically rated corporate bonds (especially in periods of rising rates) and have provided “shock absorbers” in the form of credit enhancement and other structural features which have been effective risk mitigants during times of stress (more details below). CLOs are an efficient way for investors to tailor their risk and exposure to the leveraged loan asset class by either taking a more conservative/de-leveraged exposure via participation in the AAA-BBB tranches of the capital structure, or a more leveraged exposure via participation in the non-IG tranches and CLO Equity. CLO tranches are mostly structured as floating rate securities and therefore have minimal interest rate duration This article further explores how an allocation to EUR IG CLOs could provide diversification to an investors’ fixed income/credit allocation.

Historical EUR CLO Performance

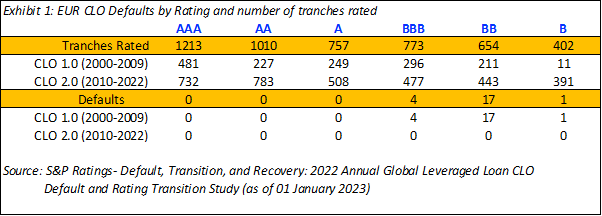

As can be seen from Exhibit 1, EUR IG CLOs have a long track record of consistently strong performance. The AAA to A tranches in particular have experienced zero defaults in both the CLO 1.0 and the current CLO 2.0 vintages over a period of 22 years. During this 22-year period, Astra and the wider market has witnessed several crises and bouts of volatility, including the telecom led crisis in the early 2000s, the global financial crisis in 2008, the EU Sovereign Crisis in 2011, the oil & gas stress in late 2015 and early 2016, and more recently the Covid-19 pandemic. EUR IG CLOs have weathered these storms well, but obviously that is not to say that there has been no mark-to-market volatility.

More credit enhancement in EUR CLO 2.0 vs. EUR CLO 1.0 structures

In the aftermath of the GFC, the capital structure for EUR CLO 2.0 has become more conservative and offers investors additional protection in the form of greater credit enhancement, as shown in Exhibit 2. What this essentially means is that EUR CLO debt tranches can withstand more losses in the underlying loan portfolio before taking a first euro of loss. Credit enhancement can also be thought of as the loss absorbing buffer available to a particular tranche. Higher rated tranches have larger credit enhancement.

Another way to demonstrate the robustness of the AAA-BBB tranches is to look at what constant default rate (“CDR”) each tranche can withstand before experiencing a 0% IRR/Yield to Maturity. Exhibit 3 below shows this for a representative EUR CLO AAA tranche issued in the primary market. Exhibit 4 shows the IRR/Yield to Maturity breakeven for the AAA-BBB tranches for various recovery rates.

Exhibit 3: EUR CLO AAA: breakeven for various recovery rates

Exhibit 4 illustrates the breakeven CDR that a tranche can withstand for a typical new issue EUR CLO and given recovery rates. The breakeven is defined as 0% IRR (i.e. return of initial principal). For example, at the AAA level for an assumed 40% recovery rate, the underlying loan portfolio would need to incur a constant annual default rate of 48.9% for the tranche to lose money. Even at the BBB level, for the same 40% assumed recovery rate on the underlying loans, the portfolio would need to incur a constant annual default rate of 13.0% for the investor not to get their money back. The reader should note that Exhibit 4 is based on a specific deal and these breakeven CDRs will differ somewhat for each deal.

To put this into context, as per Standard and Poor’s, for the period between 2003 and 2022, the long-term average recovery on first-lien corporate debt in Europe remained broadly stable at 72.8%2. The average default rate on European leveraged loans from 2007-2022 was 2.8%3. The chart below provides the annual default rate for the European leveraged loan index for the period 2007-2022. The peak default rate of just over 10% was observed at the height of the GFC in 2009 and remained somewhat of an outlier during the observation period.

Structural features of CLOs

In addition to the credit enhancement discussed above, CLOs include certain structural features in the form of Par Value and Interest Coverage Ratio tests which act as “shock absorbers” and provide additional protection to the debt tranches. These tests are designed to divert cash flows from the more junior tranches to amortise/de-risk the senior tranches in the event of portfolio deterioration – such as defaults and/or an increase in the Caa/CCC buckets – and are an additional form of credit support to the tranche.

The CLO documentation further contains portfolio construction rules in the form of eligibility criteria, portfolio profile tests and collateral quality tests. These are designed to set limits for certain risk parameters, thus ensuring that the CLO manager maintains the quality of the portfolio. Some of the more common tests include: a minimum percentage of senior secured loans (and bonds); maximum exposure to any single obligor; constraints as regards Caa/CCC obligations; Moody’s WARF Test; Moody’s Diversity Test; Weighted Average Life test.

Spread pick-up / relative value to Corporates

Last but not least, CLOs offer an excellent spread pick-up versus equally rated corporates, and IG rated tranches practically eliminate any idiosyncratic risk. As of 23 January 2024, we see the respective spread differential as shown in Exhibit 5.

Conclusion

Spreads in EUR IG CLOs remain attractive and in conjunction with the floating rate nature of the product – and Astra’s view that risk free rates will stay higher for longer – could become an increasingly appealing tool for fixed-income portfolio diversification.

About Astra Asset Management UK Ltd

Astra Asset Management UK Limited is an award-winning Asset Manager investing in US & European Asset Backed Credit. It has an eleven-year track record of generating double-digit returns. The firm manages US and European Hedge Fund and Private Credit strategies across the credit spectrum including leveraged loans, mortgage-backed securities, financials, distressed structured credit, real estate lending and asset-based lending. Since its founding in 2012, Astra has emerged as a leading European Alternative Credit Manager and a lender of choice. It has delivered sustained absolute performance across varied credit sectors and delivered sustained performance across market cycles with little to no leverage and limited correlation to credit markets. Astra Asset Management UK Limited is a London-based investment manager authorised and regulated by both the Financial Conduct Authority and the US SEC, in relation to US persons.

Website:

To read more of our insights, visit us here. To see media appearances, click here.

Disclaimer

This article has been prepared by Astra Asset Management UK Limited (Astra). Astra is authorised and regulated by the UK Financial Conduct Authority and is registered as an Investment Adviser with the US Securities Exchange Commission, solely in relation to US persons. The article comprises Astra’s opinion, it is not investment advice and does not comprise a recommendation to enter into any transaction or to follow any investment strategy. Any future-looking statements may comprise hypothetical information, and you should carefully consider the risks inherent to such information when considering this article. Astra will not accept any liability based on the article or any errors or omissions therein. You should obtain professional advice before entering into any transaction or other investment decision. Capital invested is at risk, including of total loss.